Understanding and implementing risk management is not just optional; it is essential for survival and growth. The right approach can turn uncertainties into opportunities – keeping you agile and innovative even during volatile times.

In fact, this is a general sentiment across industries as it was found by a PwC Pulse Survey that 60% of businesses identified risk management as a top priority. That’s not a surprise as it’s been found that companies with a more mature and comprehensive risk management strategy perform better financially.

Ultimately, risk management allows companies to foresee potential risks and take proactive measures to mitigate them and fuels your adaptive strategy in today’s rapidly changing market.

What Makes Risk Management So Important?

The importance of risk management is underscored by the uncertain and often volatile nature of the global business environment. Every decision made by an organization’s leadership team carries a certain level of risk. More so for those seated in the C-suite, given their influential roles in shaping company strategies and making high-impact decisions. Putting that into perspective, the domino effect explains how an insignificant miscalculation or oversight can lead to extreme and sometimes unchangeable business consequences.

Consequently, it becomes crucial for organizations to have a solid risk management framework in place when formulating the corporate strategy, the innovation strategy, the organizational strategy, and management strategy. This approach makes it possible to anticipate and mitigate potential adverse impacts, thus ensuring the continuity, growth, and scalability of the enterprise. It is not merely a defensive play; a well-executed risk management process can form the foundation of strategic opportunities, giving companies an edge over their competitors.

But before getting too far ahead of ourselves about its importance lets first define what risk management is.

What is Risk Management in Strategic Planning?

Risk management in strategic planning refers to the organized process of identifying, analyzing, and prioritizing potential challenges that could hinder the achievement of business objectives. This involves the thoughtful application of management theories, practices, and procedures in key stages such as defining the context, recognizing, and evaluating risk, dealing with it adeptly, and disseminating risk-related information.

Risk management is not just about mitigating threats, but also about recognizing opportunities. It is about making informed decisions that balance risk and reward and integrating these considerations into the overall strategic plan. This approach allows organizations to proactively manage potential risks and seize opportunities, rather than simply reacting to them.

Likewise, this approach allows organizations to strategically pivot and adapt to volatile market conditions, always staying ahead of their competitors and maintaining a competitive edge in the marketplace.

How Should Risk Management Be Used?

Strategies must be developed to manage the various risks that companies may encounter. This could involve avoiding the risk, reducing the negative effect of the risk, or accepting some or all the consequences of a particular risk. Strategies can also be put in place to transfer the risk to another party. For instance, insurance is one form of risk transfer that business organizations frequently use.

Risk management should be used as a strategic tool for decision-making. It involves identifying, assessing, and prioritizing risks, and then coordinating and applying resources to minimize, monitor, and control the impact of unfortunate events. This process helps organizations to optimize their performance and achieve their objectives.

Additionally, it should be embedded into the corporate culture and strategy. It should not be seen as a separate function but should be integrated into all aspects of the organization, from planning and budgeting to performance management. This approach ensures that risk considerations are not an afterthought but are part of the decision-making process.

Let’s look at the methods of using risk management in three aspects of strategic planning, corporate, and business unit strategy.

The 6-Step Risk Management Framework

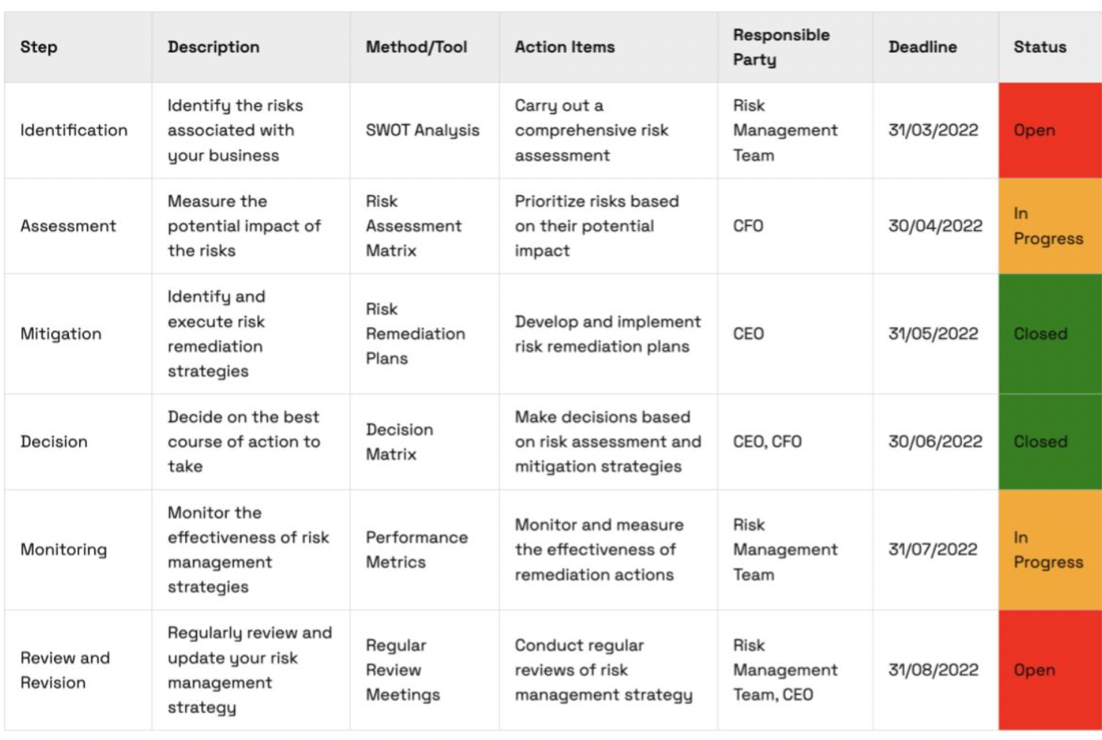

The 6-Step Risk Management Framework offers a thorough method for pinpointing, evaluating, reacting to, and handling risk. More than just a set of rules, it acts as an instructive guide for company heads towards methodical accuracy.

Let’s review how this framework can be implemented into your company strategy.

1. Identification: This step involves recognizing potential dangers and elucidating the context in which they might occur. Many businesses employ methods such as SWOT analysis for this purpose, which systematically examines their strengths, weaknesses, opportunities, and threats.

2. Assessment: This phase involves determining the likelihood of the identified risk occurring and the potential impact or damage it could bring to the organization. The outcomes of this analysis then form the basis of the strategic response to that particular risk.

3. Mitigation: follows the assessment phase. Here, strategies for managing the identified and assessed risks are devised and deployed. Mitigation strategies might include preventative measures to avert the risk, contingency plans to lessen the impact should the risk occur, or even acceptance of the risk if its potential impact is deemed negligible or manageable within the existing operational structure.

4. Decision-making: Once the stages of risk identification, assessment, and mitigation have been completed, the foundation is laid to guide decision-making. This leads to the fourth step which involves making decisions based on the previous points. This involves discerning which risks are worth taking and which are not. Always align these choices with your goals and strategic initiatives.

5. Monitoring: This step involves tracking and documenting the identified risks and evaluating the effectiveness of the implemented management strategies. Monitoring not only enables identification of any changes in the risk environment but provides valuable feedback for refining strategic decision-making.

6. Review and Revision: With the dynamic nature of the business landscape, both internally and externally, a regular review of the risk management strategy and its subsequent revision assures that the plan remains relevant and effective, equipped to meet the demands of the evolving market conditions.

Here is an example of what a 6-step framework could look like within your organization:

Risk management strategies differ greatly and are reliant on the unique circumstances, industry, and risk profile of each organization. An effective risk management strategy is one that improves a company’s resilience and adaptability when faced with unforeseen circumstances.

What is The Role of Risk Management in Corporate Strategy?

Risk management holds an instrumental role in the formulation and implementation of corporate strategy. It works as an essential bridge between strategy development and execution – the two crucial stages of corporate planning where numerous risks can emerge. These risks, if left alone, can undermine the entire strategic framework, turning potentially profitable opportunities into sources of significant losses.

In the planning phase, risk management aids in the identification and assessment of potential threats that could impact strategic objectives. By evaluating the external business environment and internal organizational factors, leaders can anticipate the potential impacts on their strategies. This allows for the design of robust and resilient strategies that can effectively navigate the dynamic market environment.

How Should Risk Management be Used in Corporate Strategy?

As mentioned before the first key principle of risk management in corporate strategy is understanding the risk landscape. This involves identifying and assessing potential risks that could impact the organization. It is about having a comprehensive view of the threats and opportunities that exist in the business environment.

Let’s dive into 5 steps on how to use risk management in corporate strategy:

1. Integrating Risk Management into Strategic Planning: Risk management is not a stand-alone activity, but rather, it is incorporated into the overall corporate strategy. It is about making risk management a part of the decision-making process at all levels of the organization.

2. Risk prioritization: Not all risks are created equal. Some risks have a higher potential impact on the organization than others. Therefore, it is crucial to prioritize risks based on their potential impact and the likelihood of their occurrence.

3. Risk Mitigation: This involves developing strategies to manage the risks identified and prioritized. Risk mitigation strategies could include risk avoidance, risk reduction, risk sharing, or risk acceptance.

4. Continuous Monitoring and Review: The risk landscape is not static; it changes over time. Therefore, it is important to continuously monitor and review the risk management strategies to ensure they are still effective and relevant.

5. Communication and Consultation: This involves sharing information about risks and risk management strategies with all relevant stakeholders. This ensures that everyone in the organization understands the risks and how they are being managed.

Now, the key to assessing and understanding your risk landscape within your corporate strategy is all about alignment and weighted decision-making. You can imagine, out of the three forms of strategic planning (corporate, business unit, and management) corporate strategy is the broadest. This means accurate representation and understanding of your organizations’ teams and divisions is a must.

This is because both these attributes allow for a seamless and unified view of the company’s strategic initiatives, prioritizing each in a quantifiable manner. Creating such a structure enables teams to base their decisions on data. This is the essence of risk management – making choices based on calculated probabilities.

How Should Risk Management be Used in Business Unit Strategy?

Its role in corporate strategy risk management in business unit strategy refers to the process of identifying, assessing, and prioritizing uncertainties that could impact the achievement of business objectives. It involves developing and implementing strategies to mitigate these risks, thereby enhancing decision-making and strategic planning.

Here are 5 steps to execute risk management in your business unit strategy:

1. Align Risk Appetite with Strategic Goals: Ensure that your organization’s risk appetite—that is, the level of risk it is willing to accept in pursuit of its objectives—is in alignment with its strategic goals. This involves identifying strategic risks and assessing their potential impact, thereby providing a solid foundation for effective risk management.

2. Incorporate Risk Assessment into Decision Making: Adopt a forward-thinking approach that integrates risk assessment into all key decision-making processes. This includes not just financial considerations, but also those related to reputation, operational efficiency, and compliance. By making risk assessments a routine part of decision-making, leaders can cultivate a more risk-aware culture throughout the organization.

3. Use Data-Driven Tools: Utilize tools which allow for data-backed insights. Take for example, a feature from SaptaAllocation, which allows you to appraise business scenarios using a weighted scorecard, align potential initiatives with your company’s predefined priorities. This way you can remove the emotional aspect from decision-making and replace it with data-driven insights.

4. Implement Continuous Monitoring: Regularly monitor and review your risk management strategies to ensure they remain current and responsive to evolving risks. This continuous process aligns risk management with strategic planning, ensuring that risks are identified as soon as possible and allowing for swift, proactive responses.

5. Foster a Culture of Transparency: Promote openness and transparency in all aspects of risk management. Encourage team members to report risks and vulnerabilities and ensure that risk information is shared broadly and routinely across your organization. A transparent culture, especially one with the principles of decentralized and open innovation, nurtures trust and encourages collective problem-solving, strengthening the effectiveness of risk management.

A common theme between both corporate and business unit strategy is strategic planning from a leadership group, which also lays the groundwork to guide decision-making across departments and leadership within a company.

Let’s further investigate how risk management significantly impacts executive decision-making.

What are the Benefits of Risk Management in Executive Decision-Making?

Risk management enhances executive decision-making by providing a structured approach to identifying, assessing, and mitigating risks. This systematic process allows executives to make informed decisions, considering potential threats and opportunities. Companies with effective risk management strategies are 33% more profitable than their competitors. Hence, the leaders armed with apt data can balance risks against rewards and make informed decisions.

1. Proactive Decision-Making: Risk management also promotes proactive decision-making. Instead of reacting to crises as they occur, executives can anticipate and plan for potential risks, thereby reducing the impact of any adverse events. This proactive approach can lead to increased stability and resilience in the face of uncertainty.

2. Resource Allocation: Another benefit of risk management is that it aids in resource allocation. By understanding the potential risks and their impacts, executives can prioritize resources more effectively, ensuring that they are directed towards areas of highest risk or greatest opportunity.

3. Transparency and Communication: By openly discussing risks and their potential impacts, executives can create a culture of openness that encourages employees to share their own insights and concerns. This can lead to better decision-making at all levels of the organization.

4. Organization Reputation Improvement: By demonstrating a commitment to managing risks effectively, organizations can build trust with stakeholders, including customers, employees, and investors. This can lead to increased customer loyalty, employee engagement, and investor confidence.

5. Innovation: By encouraging a culture of risk-taking within the bounds of a well-managed risk framework, organizations can foster creativity and innovation. This can lead to the development of new products, services, or processes that can give the organization a competitive edge.

Overall, for CxO-level decision making, implementing risk management is invaluable. It offers a understanding of the rewards and risks associated with their decisions, facilitating choices aligning with strategic objectives. Incorporating risk management into the roots of decision-making processes, executives not only enhance their odds of reaching company goals but also pave the way for organizational success.

Start Actively Practicing Risk Management

Incorporating risk management as a key pillar for an adaptive strategy as it gives a sure way to measure expectations and align with the best, next steps for your company. Prioritizing a data-driven model to plan capital allocation and efficiency can prevent over leveraging, especially during uncertain market conditions. However, a passive attack plan can result in missing quarterly goals and losing out on potential growth opportunities.

Managing risk is essential for maintaining agility, particularly in competitive business environments. Managed risks can pave the path for groundbreaking products, services, and customer experiences. However, if risks are not systematically managed, businesses become ‘stuck in stand’ unable to pivot and quickly overshadowed by hazards, liabilities, and setbacks.

In the end, the responsibility for these decisions falls on the leaders of the company. It is vital that risk management is part of your Business Unit Strategy.

This will make sure that aiming for growth and innovation will not disturb the balance of your organization.

Follow us on LinkedIn to get all the latest Adaptive Insights.